Premium finance: why the fuss?

Remember those funny little adverts at the back of newspapers? They were so profitable, media tycoon Rupert Murdoch called them ‘rivers of gold’.

But rivers can dry up, and the rise of online search drained the flow of money from classified newspaper advertising.

As the regulator looms large, people are asking whether the same will happen to premium finance.

Premium finance is a profitable sector. Lenders can make 50p on the pound in profit. It is lucrative income for many brokers.

The only publicly available industry data on premium finance came from the Financial Conduct Authority in 2019.

FCA data

If we want to understand why premium finance is so important for the UK insurance industry, let's remind ourselves of those figures.

The details are buried away on the internet, but after a bit of searching, can be found in a 2019 annex in the FCA market study on pricing practices.

The data is revealing.

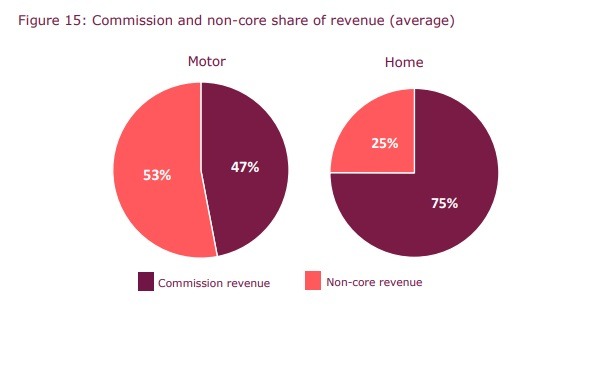

Non-core revenue makes up more than half of brokers’ motor income and a quarter of household.

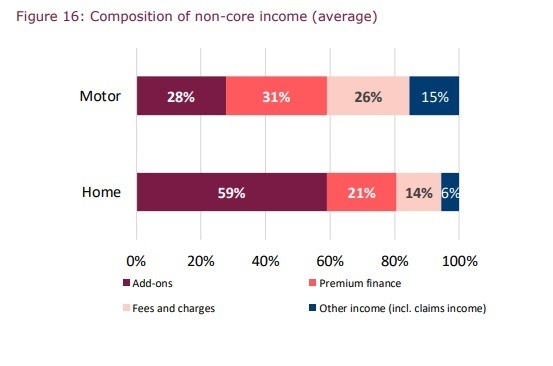

In motor, nearly a third of that non-core income is from premium finance.

This is an important source of income for many brokers. They may be subsiding other parts of their business through premium finance.

Rethinking the model

Intervention by the regulator could hurt profits, potentially triggering a major shift in their business models.

Will they sell their businesses in response? Find new products? Try and ‘get round’ any regulatory action?

FCA insurance chief Matt Brewis told Insurance Post premium finance was a ‘tax on being poor’.

Brokers will argue it helps customers spread payments, helpful during a cost-of-living squeeze.

They worry the customer will become the ultimate loser, as they pull back from offering the product.

The ABI is working hard in the background to find an industry solution. Commendable, although our track record on finding solutions through market collaboration is not good.

Something must give.

Personal lines brokers are entrepreneurs who usually find a way, but they might just find the once abundant river of profits flowing from premium finance end up shallower.